Custodian & MPC Wallet

DeFi Portfolio Performance Monitoring & Analytics

What's at stake?

Digital Assets Custody Providers are busy building gateways for mass adoption of the future of finance; helping retail new entrants take their first steps, OG traders to access a variety of digital asset operations or institutions to manage their digital asset business.

Whether based on Conventional, SmartContract or MPC wallets, security is at the core of all solutions with various compromise on flexibility, complexity, governance policies, ...

As a gateway to all type of digital asset operations, Custodians provide easy to use & straightforward access to trading venues, exchanges, DeFi investment protocols (lending, liquidity), staking, NFT, ... for a seamless service adoption.

Last but not least, providing an extensive ecosystem with new services based on new features and integrations is key to improving retention. Extra services such as Portfolio Reporting Dashboards provide an overview on the current exposures, the investment diversification strategy and the P&L performance vs the current market & assets volatility.

How can MERLIN help?

For all DeFi related activity, MERLIN can power up Custody solutions with portfolio exposure and performance analytics; to complete the overall portfolio reporting and keep the User within the Custody solution even for DeFi related portfolio analysis.

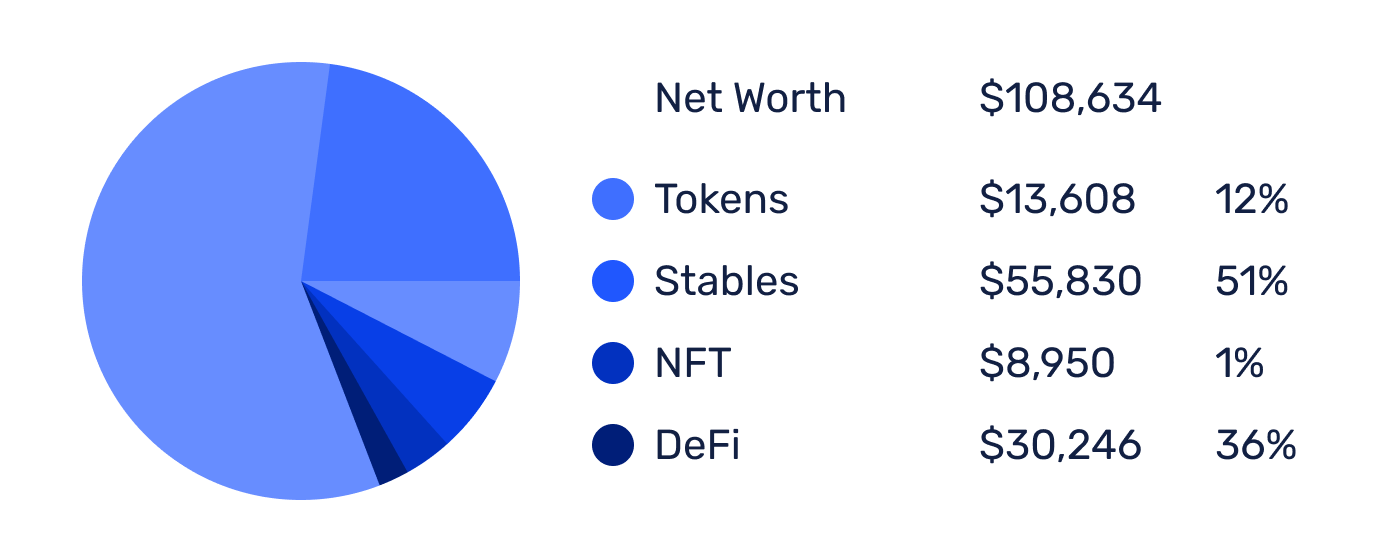

Overall DeFi NAV

The Users' general portfolio overview can be enriched with their current DeFi exposures. You can now track users' holdings which are currently invested in DeFi.

DeFi conservatives or DeFi addicts? MERLIN provides the most extensive DeFi protocols coverage 1,500+, across 25+ chains: not limited to EVM chains, supporting also Solana, major Cosmos chains and others. Please check the exhaustive protocols supported list here.

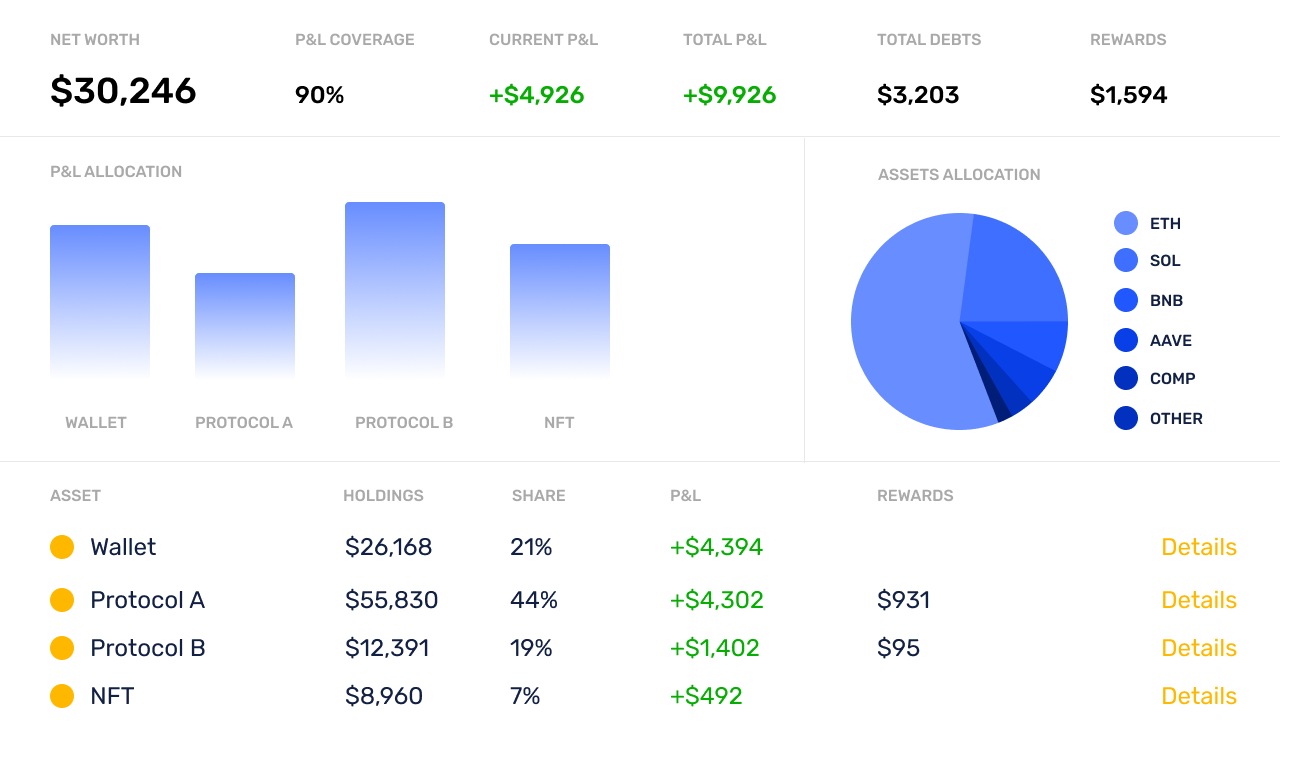

DeFi Portfolio Dashboard

An overview of the DeFi holdings is good, a DeFi Portfolio Dashboard is great! For users to track the allocation of their funds across the different DeFi investment protocols.

MERLIN's portfolio performance analytics can power up a unique DeFi Dashboard view:

No need to integrate with each DeFi protocol in order to find your users' exposures, MERLIN is your unique source of DeFi portfolio analytics! With precise USD valuation of the DeFi holdings, based on actual protocol USD exchange rates.

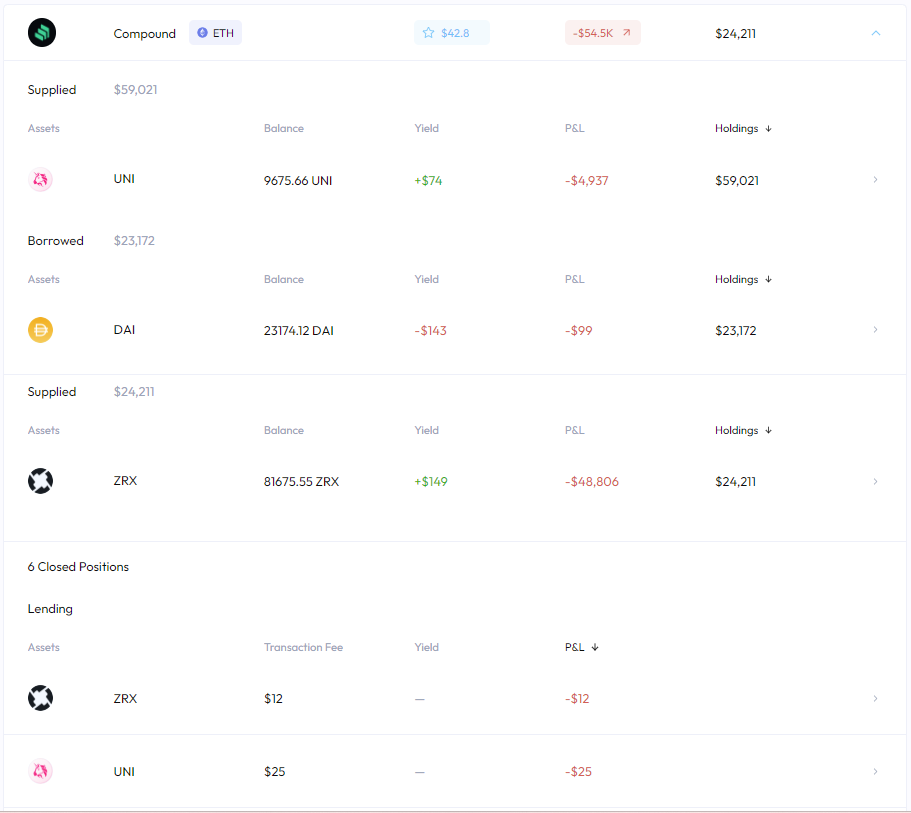

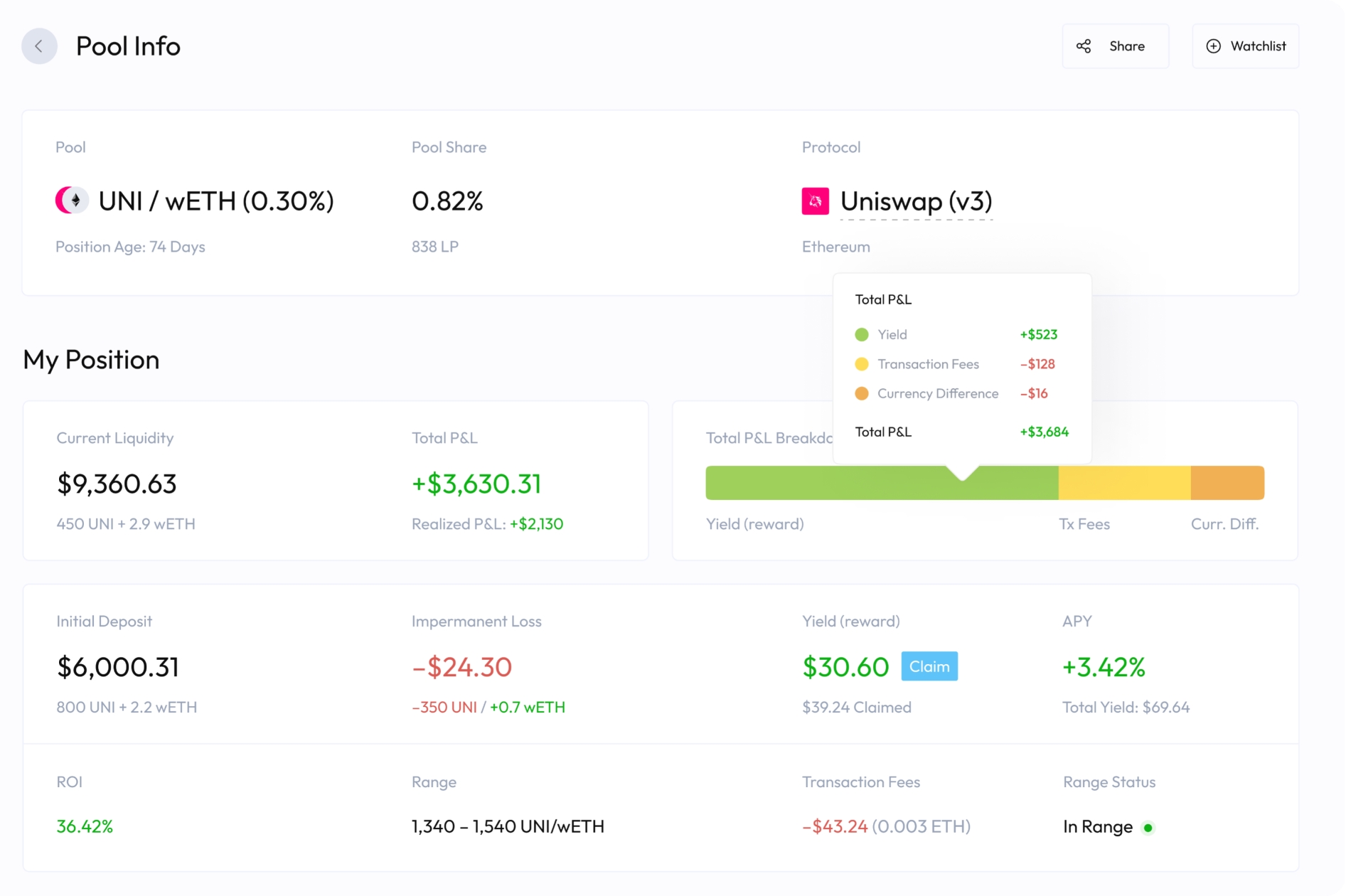

DeFi Positions Overview

Are your users DeFi enthusiasts? Is your Custody solution focused on DeFi? It would be great for users to track their individual DeFi positions directly via your Custody environment, and thus maintain them within your ecosystem.

MERLIN is the only DeFi data provider capable of delivering DeFi position details for both currently active (open) investments - for live monitoring purpose, but also for historical past (closed) investments - for analysis purpose.

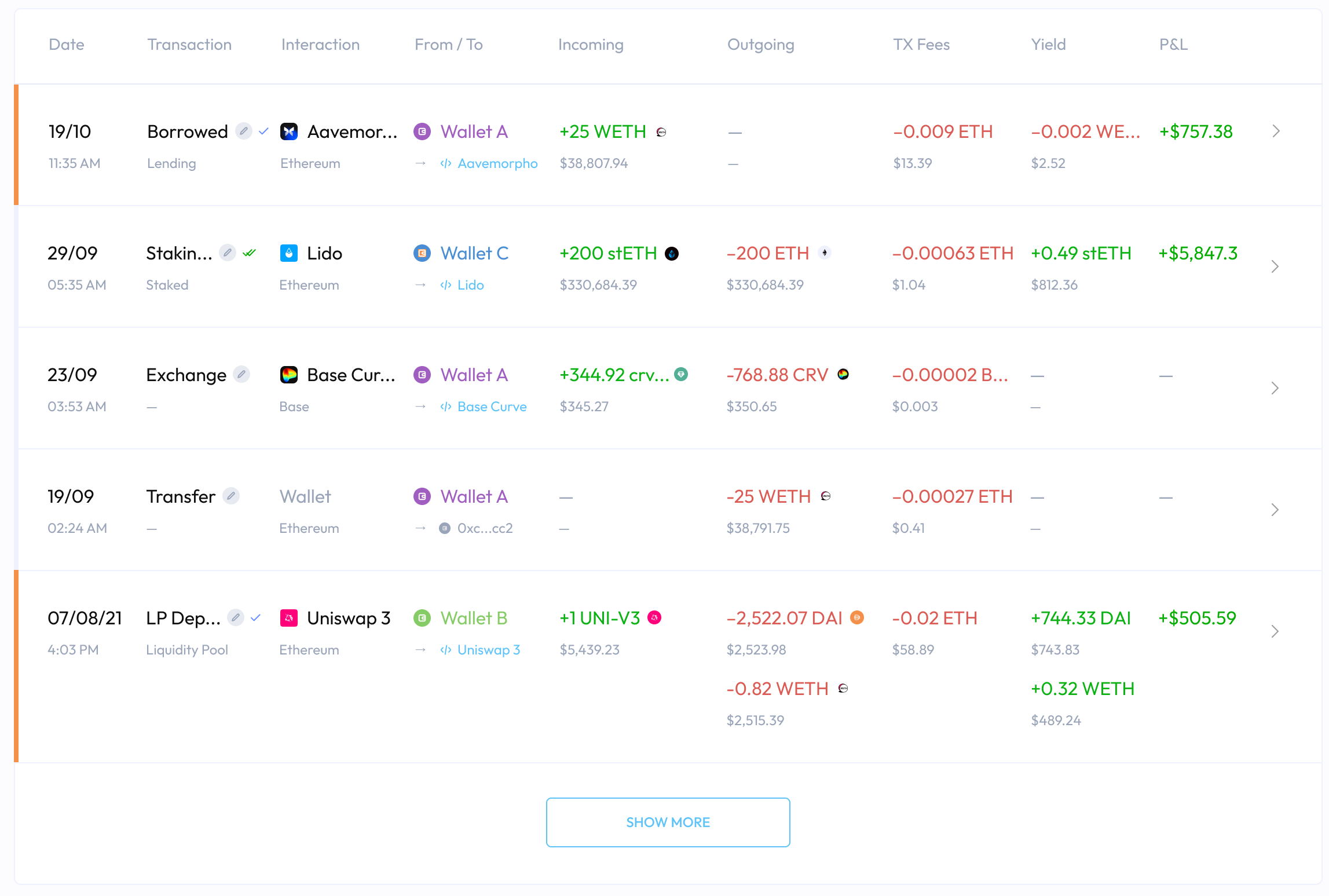

With the most detailed information for a full visibility over the investment: Yield, Transaction Fees, Asset Currency volatility, and all position's related transactions.

DeFi P&L USD valuation

You can go all the way in terms of performance performance tracking by proposing P&L statistics for major DeFi investment strategies.

In a crypto volatile market, the investment's Yield might be positive, but that might be not be enough to cover the underlying price volatility. In case of fiat exchange rate important drop, the bottom-line overall P&L might be negative.

Based on actual on-chain data (indexation), MERLIN takes no guess when it comes to Yield, Gas fees, Rewards, Impermanent Loss, Entry Price to produce an accurate P&L. With precise USD valuation, based on protocol USD exchange rates at the precise operation execution time.

P&L analytics available for top DeFi platforms, please check the exhaustive protocols supported list here.

DeFi Transaction history

The users' portfolio transaction history can only be more complete with all DeFi related activities!

Across Staking, Farming, Lending, Borrowing & Liquidity Pool positions, MERLIN understands all investment strategies and their associated transactions for reporting & accounting reconciliation purposes.

Thanks to MERLIN, all on-chain actions can be classified, for the user to know precisely which Protocols his wallet has interacted with.

Integration & Pricing

MERLIN is build around an online application (web app), mymerlin.io, available to everyone, proposing a DeFi portfolio performance dashboard as well as insightful DeFi market data analytics. All data powering up the MERLIN web app is available as a API, api.mymerlin.io, for integration with third party proprietary systems.

Full integration

Optimize your solution around DeFi tracking and propose your own DeFi module to your clients by pulling MERLIN API data.

The MERLIN team can assist all throughout the process: beginning with the feature design, the API testing getting started & eventual adaptations for a smooth integration within your system.

MERLIN API pricing is a pay-per-use model: price per endpoint & per call.

Light integration

You propose a resource catalog with relevant applications for your clients?

They can be one click away from their DeFi Portfolio Performance tracking with the MERLIN web app.

Why MERLIN?

THE one place to get both P&L performance reporting for the major DeFi protocols and NAV for 1,500+ others, across 25+ chains

Optimize operation & maintenance by reducing the number of third party solution integrations

Focus on your business value proposition and leave the tedious on-chain data fetching & assessment to MERLIN

Leverage on MERLIN’s DeFi performance data to complete & add value to your business offer

Easy start with a pay per use, powerful & straightforward API

Partner for the future with a pure DeFi player: 3+ years in business, providing a wide range of DeFi data services (Portfolio P&L, Market Performance, ...)

Last updated